Savology provides a next-level, personalized financial assessment that complements high-level burnout and turnover assessments, such as the Well-Being Index, developed by the Mayo Clinic.

The assessment takes less than ten minutes to complete (6 minutes on average) and does not require sharing any personally identifiable information.

You immediately receive a report card providing grades across all aspects of personal finance.

The report card curates a robust learning management system with physician-specific content.

You also receive action items specific to your situation without bias or conflicts of interest.

From there, you can explore dozens of financial planning tools and set up a dashboard to track your progress and make informed decisions – either independently or with guidance from our team of experts.

Conflict-Free Tools & Resources

Unfortunately, the misaligned financial incentives of many financial advisors often cause a feeling of “being sold” and do not foster trust.

Our tools and resources do not lead to any specific product recommendations.

Instead, our goal is to develop educated consumers who are confident and capable of navigating the complex universe of options for implementing their plans.

Financial Dashboard & Professional Guidance

We believe physician families deserve a comprehensive financial dashboard and access to professional guides to help them make good decisions.

We offer an unbiased, economical “on-ramp” to financial planning with no advertising or products to sell.

We nurture our clients throughout their financial planning journey and look for opportunities to refer them to our trusted network of specialists when their needs exceed what we offer.

We’ve built strong partnerships with top university Personal Financial Planning programs to power our Financial Planning Residency Program.

Through this program, we hire, train, support, and pay emerging planners as they work toward becoming Certified Financial Planners®.

fpGuides gain hands-on experience delivering real financial guidance under professional supervision.

They receive ongoing mentorship from experienced CFP® professionals and financial specialists.

This model delivers high-quality, conflict-free financial education and planning support—at scale and at low cost.

fpGuides

The foundation of financial planning is organizing your financial life in a way that allows for informed decisions. We partner with ASA Financial to provide you with a comprehensive view of assets and debts using their patented, military-grade security and privacy platform.

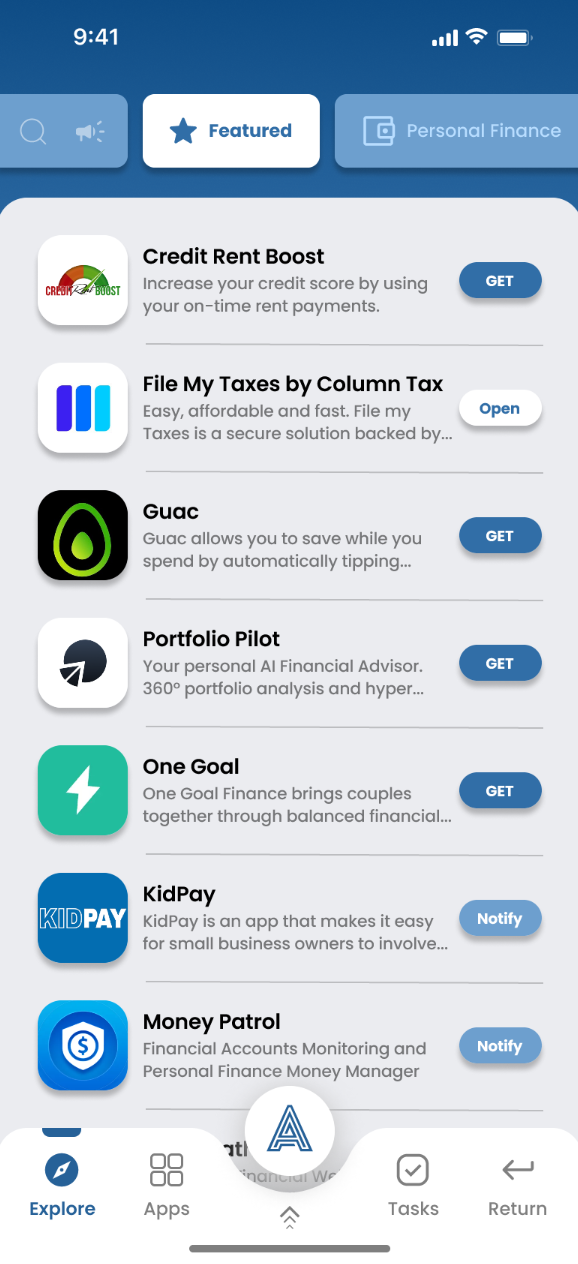

The ASA Vault gives you ultimate visibility and control over your financial and personal information and helps to reduce the threat of fraud dramatically. The vault provides safe, secure, and private access to many financial planning and well-being apps.